What are Accounting Principles?

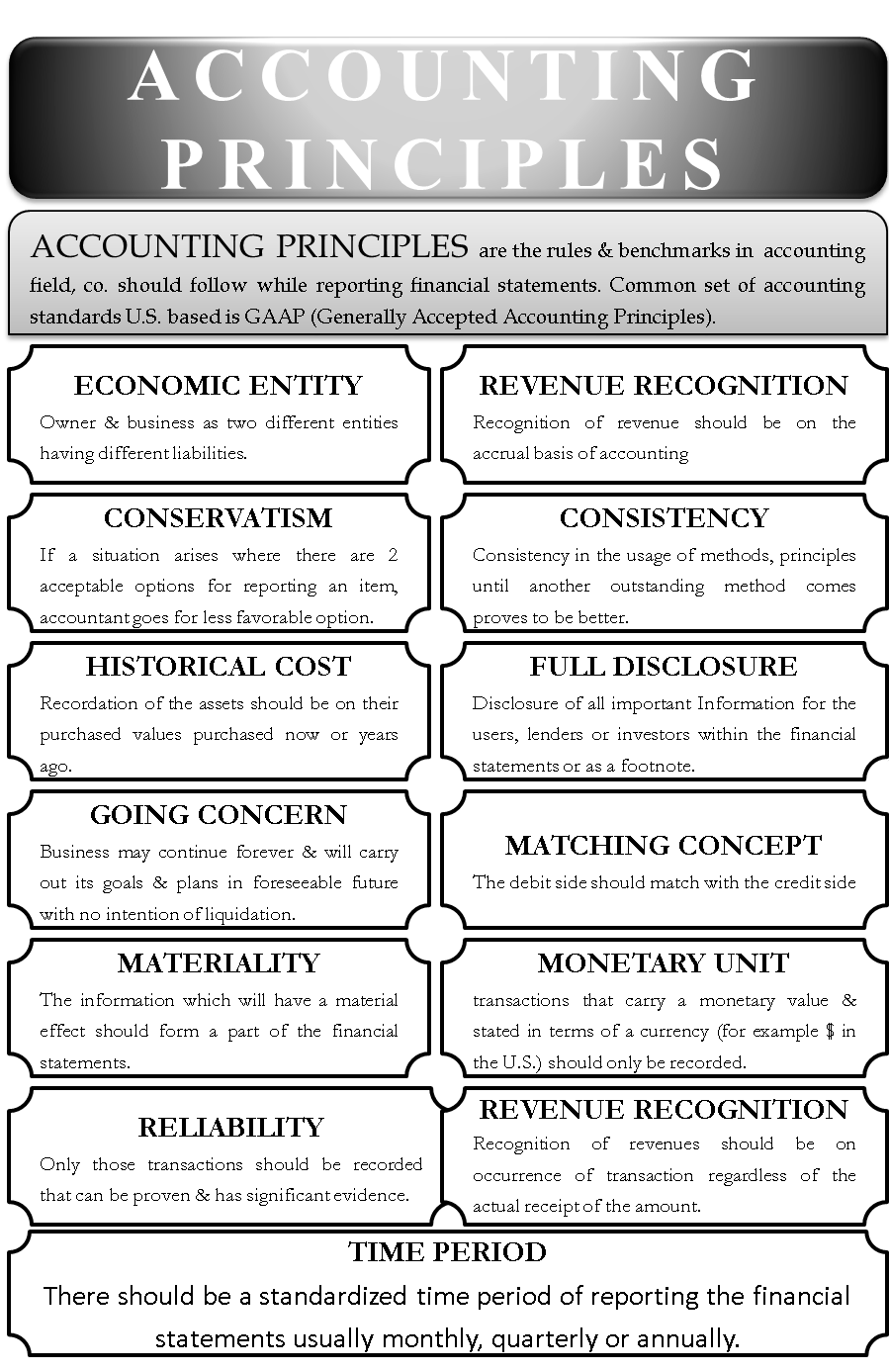

Accounting Principles are the rules and benchmarks in the accounting field, a company should follow while reporting the financial statements. The common set of accounting standards as per the U.S.A. is GAAP (Generally Accepted Accounting Principles). However, these accounting Principles may vary from one country to another, but the principles are more or less of the same type and fashion. These standards are framed so that they can easily be understandable and universally acceptable all over the world.

List of Accounting Principles

- Economic Entity Assumption

- Revenue Recognition

- Conservatism

- Consistency

- Historical Cost

- Full Disclosure

- Going Concern

- Matching Concept

- Materiality

- Monetary Unit

- Reliability

- Revenue Recognition

- Time Period

Economic Entity Assumption

This accounting principle treats the owner and the business as two different entities and they both have different legal liabilities. The transactions of the business should be kept and treated separately from the owners and other businesses.

Revenue Recognition

The recognition of revenue should be on the accrual basis of accounting. In the accrual concept, one should record the business transactions in the time periods when they actually occur and not on the basis of the cash flows correlated with that. This is necessary for the preparation and formation of Financial Statements at the end of the year. Say there is a sale to a debtor of $2000 on 5th August 2018. So it’s recognition should be on 5th August only regardless of the debtor’s immediate payment or not.

Conservatism

If a situation arises where there are two acceptable options for reporting an item, an accountant tends to go for a less favorable alternative due to the conservatism concept. One should record the expenses, the earliest possible even if there is an uncertainty about the outcome and the incomes, the latest possible only if there is a certainty. This principle encourages the recordation of the expenses and liabilities earlier rather than later. Hence, this affects the overall financial position of the business by showing less net profits.

Consistency

This accounting principle states that one should be consistent enough in the usage of the methods and the principles once adopted until another outstanding method/principle come across. This means that one should follow the methods continuously until another method outstands the current one. One should prove the new method with a demonstration and then come up to the conclusion.

Historical Cost

According to this accounting principle, the recordation of the assets in the financial statements should be on their purchased values. Then, may they be purchased today or twenty years ago. There may be a change in the value of the assets over time due to the depreciation or inflation. But one does not show this change in the financial statements due to the Historical Cost principle.

Full Disclosure

There has to be a disclosure of all the necessary information that is important for the users, lenders or investors within the financial statements or as a footnote. One gets a clarity of a particular aspect if there is a proper mentioning of the required information. Without this accounting principle, the readers may not understand the full information and may not make a sound judgment.

Going Concern

This accounting principle assumes that the business may continue forever. It will carry out its objectives and plans in the foreseeable future with no intention of liquidation.

Matching Concept

This accounting principle states that the company should go for Accrual Basis only. The revenues should match with the expenses. The recordation of the revenues and expenses should be at the same time only.

Materiality

This accounting principle states that the information which will have a material effect should form a part of the financial statements. The information that is not material and by which the users don’t get mislead can be avoided.

Monetary Unit

This accounting principle states that there should be the recordation of only those transactions that carry a monetary value. The transactions stated in terms of a currency (for example $ in the U.S.) should only be recorded. The monetary unit should be stable and dependable.

Reliability

This accounting principle states that only those transactions should be recorded that can be proven and has significant evidence. For example, in order to prove an expense, its invoice is enough. The auditors are constantly in search of evidence and hence, this principle is of prime interest for them.

Revenue Recognition

The recognition of the revenues should be on the occurrence of the transaction (the sale of a product or the performance of service) regardless of the actual receipt of the amount. Say, for an example the service for a particular product is of $2500. Its recognition should be at the time of the completion of the service. Even though there has been an actual receipt of the amount or not amount.

Time Period

This accounting principle states that there should be the standardized time period of reporting the financial statements. The time period is usually monthly, quarterly or annually. The header of the financial statements should cover the time period, the statement covers.

(Source: efinancemanagement.com)