Expenses are as important for a company as revenues. A business can’t earn revenue, if it does not make necessary expenses. We can divide business expenses primarily into capital expenditure or CAPEX and operation expenditure or OPEX. Both the expenses are related to business in a way that capital expenditure is concerned with the heavy goods or property purchases that has a long-term life. Operational expenses, on the other hand, are concerned with the day-to-day operations of a company. To better understand the two and their importance, let us see the differences between CAPEX vs OPEX.

CAPEX vs OPEX – Differences

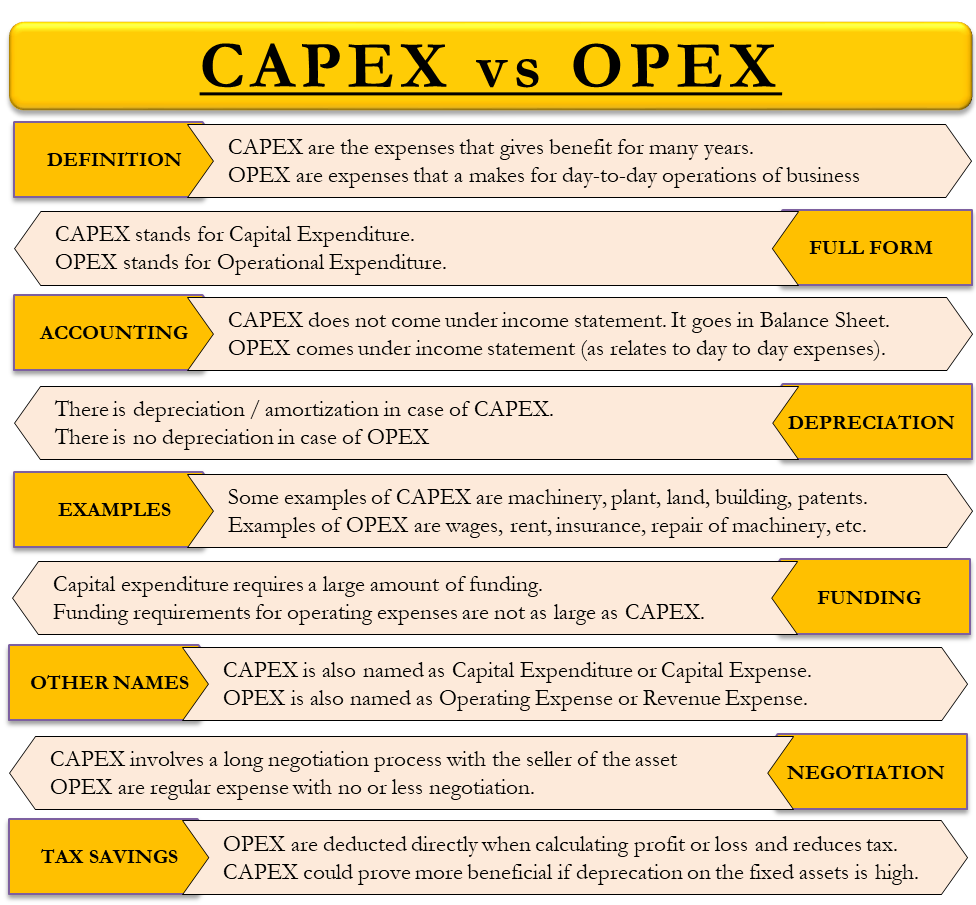

Following are the differences between CAPEX vs OPEX:

Definition

Capital expenditure are the expenses made by the company on the items that is beneficial to the company for many years. When a company buys fixed assets or upgrades the existing facilities, it comes under capital expenditure. Operational expenditure, on the other hand, refers to the expenses that a makes for day-to-day operations of business such as sales expenses, administrative expenses and more.

Accounting Treatment

Capital expenditure is not treated as an expense, and thus, it does not come in the income statement. Rather, a company capitalizes the CAPEX. To decide whether or not an expense should be capitalize, one usually follows a general rule. If the useful life of the property is more than the taxable year, then an accountant should capitalize the cost.

On the other hand, operating expenses come in the income statement in the accounting year when a company incurs them. Since a company incurs these expenses for day-to-day business, they are shown in the same accounting period.

Income Statement or Balance Sheet

Capital expenditure comes in the balance sheet, but the depreciation on fixed asset comes in the income statement. Operational expenditure, on the other hand, comes in the income statement.

Depreciation and Amortization

CAPEX over the tangible asset is subject to depreciation, while those over intangible assets are subject to amortization. There is no depreciation or amortization in case of operating expenditure.

Profit

Capital expenditure is a big investment made by the company, usually for acquiring an asset that would be helpful for the company in the years to come. Therefore, a company would continue to earn profits from that asset for years to come. Operating expense, however, are immediate costs. The income that a company earns from such expenses is for a very short period.

Examples

Some examples of CAPEX are machinery, plant, land, building, patents and more. Examples of OPEX are wages, rent, insurance, maintenance and repair of machinery and more.

Funding

Capital expenditure requires a large amount of funding. Often a company borrows from lending institutions to buy assets or to make CAPEX. Funding requirements for operating expenses are not as large as for capital expenditure. Therefore, the companies use their own sources to make such expenses.

Other Names

Capital expenditure is also known as CAPEX or Capital Expense. Operation expenditure is also known as OPEX or Operating Expense or Revenue Expenditure.

Negotiation

Usually, CAPEX involves a long negotiation process with the seller of the asset, but OPEX are regular expense with no or less negotiation.

Tax Saving

Usually, it is the OPEX that help a business to save more taxes. Since OPEX are deducted directly when calculating profit or loss, they help in lowering the profit, and this leads to lower taxes. However, CAPEX could prove more beneficial if the deprecation amount on the fixed assets is high.

For example, a company has an option to buy a machine for $50000 with annual depreciation of $5000, or to rent the same machine for $3000 annually. In this case, from a tax perspective, it is beneficial for the company to buy the machine.

Final Words

After reading the above point, you will have realized that both capital expenditure and operation expenditure are important for the survival of the company. Both have their own pros and cons. For instance, OPEX may be better from a tax perspective, but CAPEX allows a business to increase the size of its balance sheet. Thus, it is very crucial for any business to understand the difference between CAPEX vs OPEX.

(Source: efinancemanagement.com)